Breakfast | Trump's re-election rate soared after the attack! These concept stocks may be worth watching

Elon Musk stated that he fully supports Donald Trump, comparing him to Roosevelt during World War II; if Trump wins the election, it will be beneficial for industries such as digital currency, automotive, energy, and finance; the US stock earnings season has begun, with companies like TSMC, ASML, and Netflix announcing their earnings this week

Good morning! A great day starts with making money.

Trump Attacked and Trending

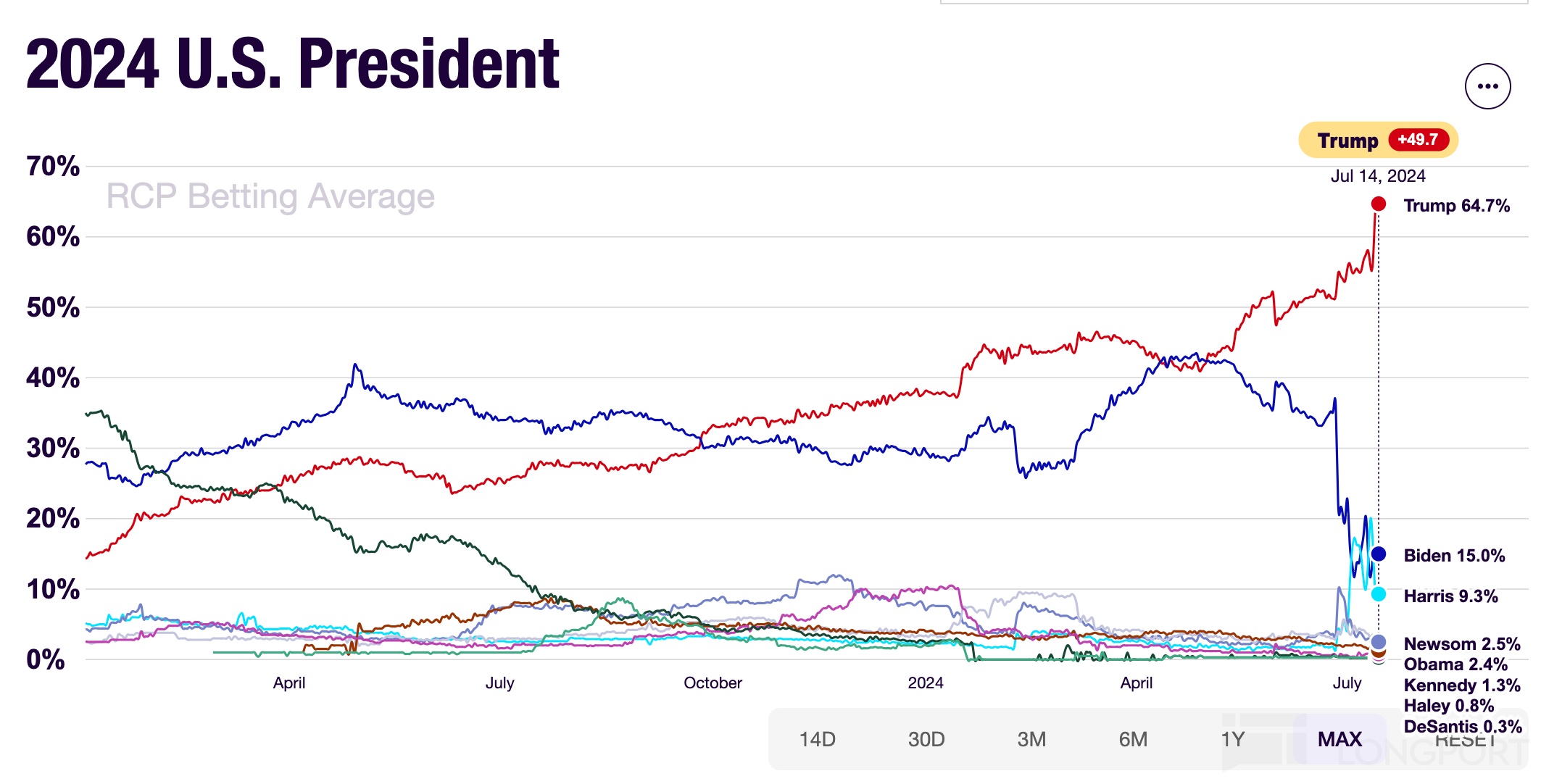

Local time on Saturday, US presidential candidate Trump was shot at a campaign rally, which could be a key moment in changing the landscape of this year's US election.

In history, President Reagan's approval rating rose by 22 percentage points after surviving an assassination attempt.

Recently, Biden's support rate has dropped significantly after a televised debate.

Images of Trump being injured are quickly going viral.

On X, Musk also stated that he "fully supports Trump" and is "comparable to President Roosevelt":

After the attack on Trump, a user on X called on Musk to strengthen his security. Musk responded that in the past 8 months, he had experienced two assassination attempts, which occurred separately. "They were arrested about 20 minutes away from Tesla's headquarters in Texas, carrying firearms when they were arrested."

Which stocks are related to the Trump concept?

Wolfe Research has a list of stocks it says could be potential winners if Donald Trump were to win his presidential re-election bid and lead a Republican-controlled Congress.

Here is Wolfe's list of potential stock winners:

1) Communication Services

Trump Media & Technology Group (DJT)

2) Utilities/Midstream/Clean Energy

Cheniere Energy (LNG)

Sempra (SRE)

Energy Transfer (ET)

3) Materials

Dow Chemical (DOW)

Linde (LIN)

Nucor (NUE)

4) Industrials

Emerson Electric (EMR)

3M (MMM)

Hubbell (HUBB)

General Dynamics (GD)

5) Healthcare

UnitedHealthcare (UNH)

6) Financials

Goldman Sachs (GS)

Charles Schwab (SCHW)

Evercore (EVR)

Discover (DFS)

Carlyle Group (CG)

Citigroup (C)

Coinbase (COIN)

7) Energy

Halliburton (HAL)

Patterson-UTI Energy (PTEN)

EQT (EQT)

Chesapeake Energy (CHK)

Valero Energy (VLO)

PBF Energy (PBF)

8) Healthcare

Humana (HUM) - YTD loss: 18%

9) Here are some politically driven Republican- and Democratic- exchange-traded funds:

Unusual Whales Subversive Republican ETF (KRUZ)

Democratic Large Cap Core ETF (DEMZ)

Unusual Whales Subversive Democratic ETF (NANC)

Point Bridge America First ETF (MAGA)

Analyst Views

According to data compiled by Bloomberg: forty years ago, when President Ronald Reagan was shot, the stock market fell before the early closure. The next day, on March 31, 1981, the S&P 500 index rose by over 1%, while the yield on the benchmark 10-year Treasury bond fell by 9 basis points to 13.13%.

BCA Research Inc.'s Chief Strategist in California stated that bond investors should pay special attention to the possibility that this attack could increase Trump's chances of winning the election.

He wrote: "I do believe that the bond market will at some point realize that President Trump's chances of winning the White House are higher than any competitor. I continue to believe that as his chances increase, the likelihood of turmoil in the bond market will also increase." S CUBE CAPITAL's Chief Investment Officer stated that there may be a rise in the US curve in the coming months. Financials and energy may perform well, but it may be unfavorable for Asian currencies.

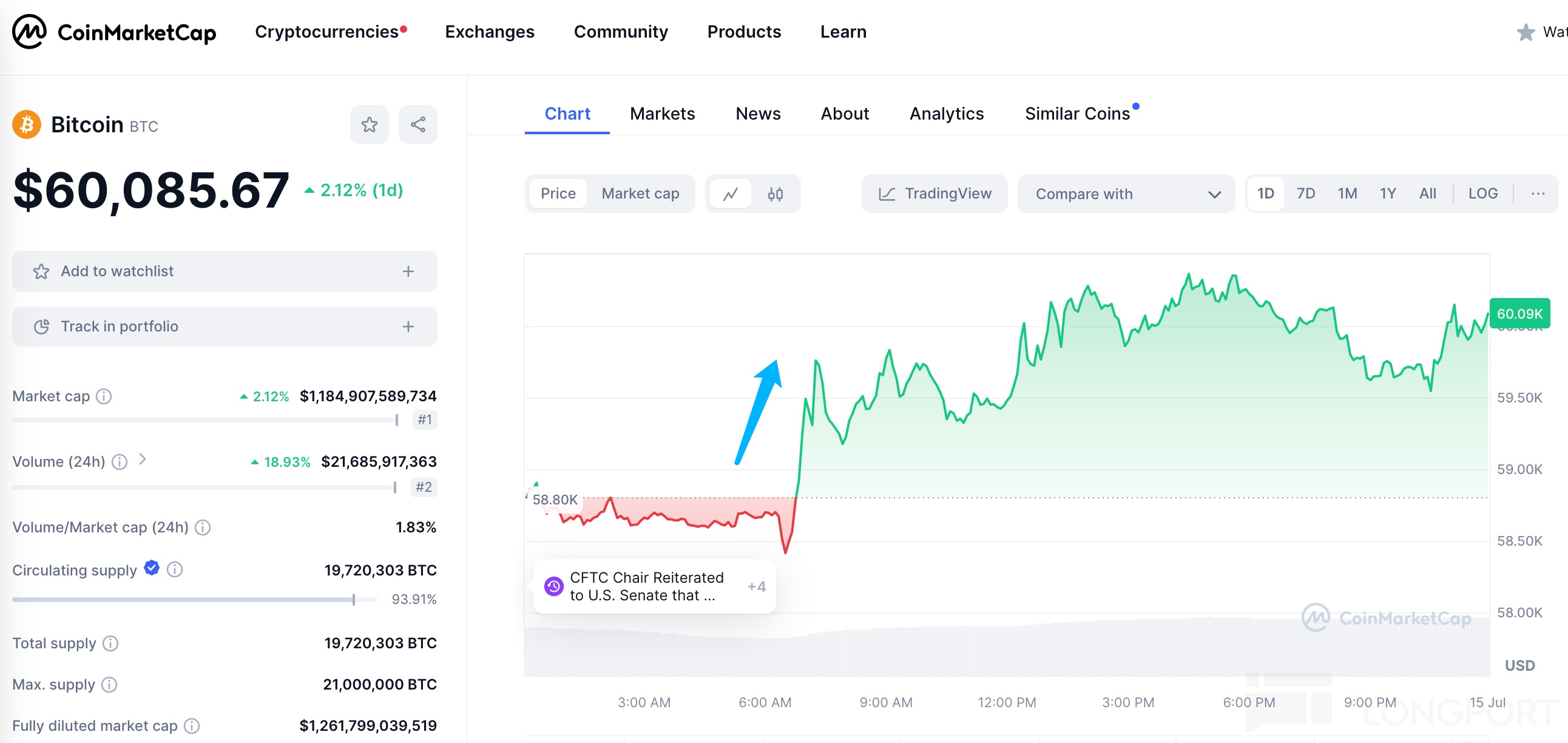

Capital.com's Senior Financial Market Analyst stated that following this shooting incident, he saw client funds flowing into Bitcoin and gold. After this news was announced, cryptocurrency prices rose, with BTC rising above $60,000:

Overnight and This Morning Market

After the release of CPI data last week, the market expects the Fed to cut interest rates in September.

Last week, large-cap weighted stocks experienced a decline, while the Russell 2000 index representing small-cap companies rose for two consecutive days, accumulating a 4.6% increase.

Important events and data for this week:

China's second-quarter GDP will be released on July 15th;

The Third Plenary Session of the Twentieth Central Committee will be held in Beijing from July 15th to 18th;

The US stock market enters the Q2 earnings season, with TSMC announcing its second-quarter earnings on Thursday, July 18th;

In addition, banking giants such as Goldman Sachs, Bank of America, and Morgan Stanley will announce their earnings this week. Companies like ASML and Netflix will also report earnings.

Blue Chips and Hot Stocks

Norway's DNB Asset Management reduced its holdings of Nvidia stock in the second quarter of 2024 and increased its holdings of Apple, Tesla, and Intel stocks.

Broadcom will split its stock on July 15th, with a 1-for-10 split.

Due to antitrust concerns, Microsoft and Apple have announced their withdrawal from the observer seats on the OpenAI board.

Chips and Artificial Intelligence

Recent data from Crunchbase shows that in just the first half of 2024, over $35.5 billion flowed into AI startups globally. Among the six rounds of over $1 billion raised in the first half of 2024, five were raised by AI companies, with other AI startups also raising over $100 million in funding.

In the first half of this year, US startups raised two $1 billion financings, accounting for nearly two-thirds (64%) of the mega financings.

Since April, ARM's stock price has doubled, skyrocketing nearly four times in less than a year, approaching $200 billion. With annual revenue around $3 billion and net profit of only $300 million, the PE ratio is close to 600 times. The surge in stock price may be related to the low float of shares. SoftBank holds 88.7% of ARM's shares. Since its IPO in September last year, the current float is very low, accounting for approximately 12% of the total shares outstanding.

TSMC will announce its earnings. Earlier sales data released by the company showed a 40.1% year-on-year increase in TSMC's sales in the second quarter, exceeding the average expectation of 36%. Wall Street expects TSMC's second-quarter net profit to increase by 29% year-on-year, reaching $1.4 per share, higher than the first quarter's $1.34 per share. Institutions such as JPMorgan Chase and Morgan Stanley predict that TSMC may also raise its full-year sales forecast

Macro: Taking You Around the World

Last week, Powell spoke at two congressional hearings, where Fed officials discussed their unprecedented confidence in controlling inflation and their determination to shift monetary policy.

Their confidence is supported by better-than-expected economic data, with CPI data showing continued downward pressure on inflation, core CPI growth hitting a three-year low, and signs of weakness in the labor market. The market generally expects the first rate cut to come in September.